On August 22, the Qingdao Wealth Forum 2020, hosted by Qingdao Municipal People's Government and hosted by Caijing and Caijing Think Tank, was held in Qingdao. The forum focused on the theme of "Wealth Management Trends under Global Changes".

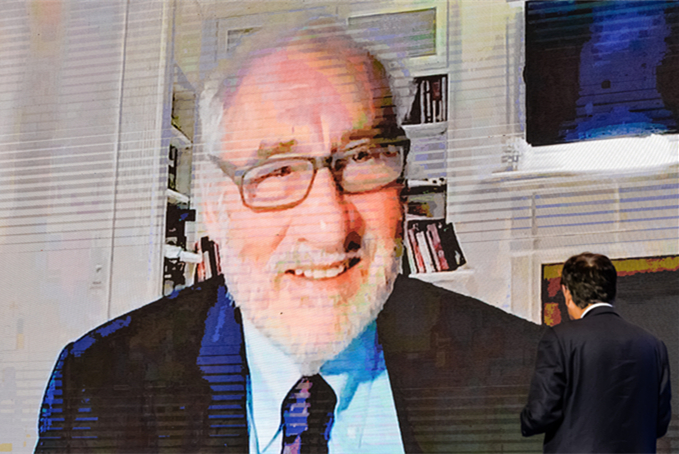

Professor Joseph Stiglitz of Columbia University, winner of the 2001 Nobel Prize in Economics, was invited to participate in the event via video link to share online the global economic situation and the impact on wealth management after the impact of the pandemic.

According to Joseph Stiglitz, the impact of COVID-19 on globalization can be seen in three aspects:

First, it exposed the lack of resilience in global supply chains and led to a rise in protectionism. There is a need to recognize that protectionist economic policies will only bring higher costs to the global economy and will entail higher geopolitical burdens. Only some countries are aware of the dangers of protectionism and have taken preventive measures, but many have not.

The second effect is to highlight the need for more international cooperation. We all live on the same planet and the virus doesn't care about borders, your passport or your visa. International institutions may not be perfect, but their mechanisms are the only way for the international community to solve international problems. Therefore, it is a great mistake for the United States to withdraw from the WHO.

Third, it permeated a series of debt crises. Many countries will be unable to pay their debts. These developing countries are unable to repay their debt, and now Ecuador and Argentina are already restructuring their debt systems.

Finally, Joseph Stiglitz talks a bit about stocks, bonds, inflation and deflation.

First, he says, many people are concerned about debt. Debt has risen rapidly in the past few months. There are also problems with central banks' balance sheets, with European central banks shrinking their balance sheets. America's budget deficit has soared to 15%-20% of GDP, an unprecedented level. At the same time, over the summer, the United States passed the tipping point for a debt-to-GDP ratio of 100 percent.

Second, why hasn't inflation gone badly wrong? It is mainly the central bank that issues this money, which people do not actually spend. One of the reasons why the economy is not active now is that people are actually more prudent and reluctant to spend.

Third, we are facing a lot of uncertainty right now, balance sheet issues, and we have to be cautious. We're actually going to get into another mistake, which is ultra-low interest rates. We may have some similar problems. In some industries in the United States, we have actually seen falling wages and other corresponding phenomena. We have mentioned these reasons before, especially the fiscal problems around the world, and the European economy will continue to be weak. The United States is in a state of fragmentation, we have a lot of stimulus measures, but the economy is still not doing well.