From November 25 to 27, Caijing Annual Meeting 2021: Forecast and Strategy was held at the International Wealth Center in Beijing. This year's annual Financial and Economic Conference once again brings together domestic and foreign political and business elites, in-depth analysis of global hot spots, a comprehensive outlook for 2021 global and China's economic, political, social, scientific and technological new trends, and jointly seek new impetus for China's and global development in the era of change.

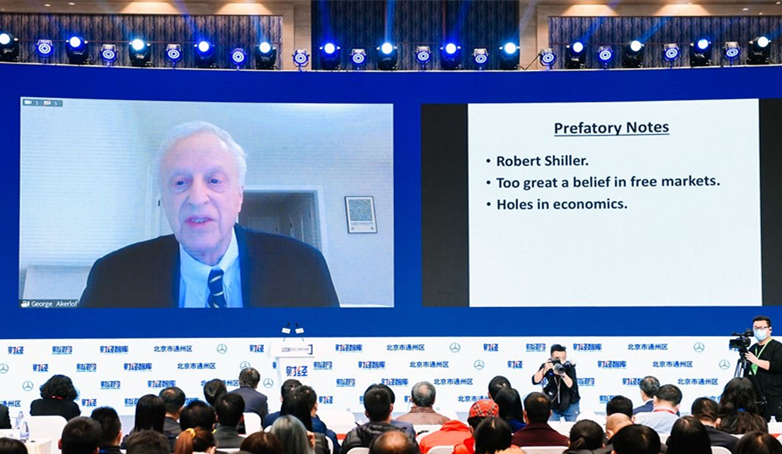

George A. AKERLOF, the famous American economist who won the Nobel Prize in Economics in 2001, was invited to attend the conference by video link, delivered A keynote speech and had a dialogue with Zhu Min, President of the National Institute of Finance of Tsinghua University and former Deputy Managing Director of the International Monetary Fund. From financial markets, economic equilibrium to capital stories, human weaknesses and other topics, we will explore the current hot economic phenomenon and the social behavior and psychology behind it.

In the conversation, George Akerlof shares his book Fishing for Fools, written with Robert Shiller, which he hopes will challenge conventional economic wisdom. He said the market is not always right, in fact it is full of deception and manipulation. The basic concept in economics is "equilibrium", so as long as the current advantages are available, there will always be someone to seize the opportunity to profit. At the same time, the free market, in its pursuit of profit, offers some false choices.

In George Akerlof's view, businessmen in the search for business opportunities will inevitably take advantage of human weaknesses to see if they can create high profits for themselves, and "once they see such an opportunity, they will choose to sell." This phenomenon is what George Akerlof called "fool fishing", and it is also an "equilibrium". In this process, if the market is not restricted, then every opportunity for excess profit will be fully exploited.

George Akerlof uses a number of interesting examples to illustrate his point. He notes, for example, that many factories produce extremely cheap snacks, and that one chain of cinnamon rolls, whose slogan is "Life needs a little sweetness," leads consumers to take sweets for granted and ignore health concerns. This is the phenomenon of "balance" and "fool fishing" mentioned above.

At the same time, George Akerlof pointed out that the modern economy's interpretation of Adam Smith's invisible hand is competition plus free markets, and the equilibrium it reaches is Pareto optimal, meaning that once the economy is in equilibrium, it's impossible to make everyone's economy better off, like a change that might make your welfare go up, But it's going to make me or Zhu Min less well off, so any intervention is going to make someone worse off, and of course the theory recognizes some of the factors that might undermine competitive free market equilibrium. Pollution, for example, or income inequality, but think about it, given certain conditions, economists believe it's true, but in a perfectly free market, there's not only freedom to choose, there's freedom to fool, so the equilibrium is still ultimately what we think of as Pareto optimal, But the optimal equilibrium we reach is not what we really want.

Finally, George Akerlof said that the book also tells us that the world's problems do not only include basic physical changes such as global warming, but also include many stories, which make us unable to effectively deal with problems when they occur, so these stories should be included in the scope of economic research. We believe that such stories can make us unable to deal effectively with our own physical or financial problems. Things like the euro, smoking, derivatives, global warming, the dog in the window, explaining the role of stories, how to curb stories that lead to bad outcomes, should be a major management function in making economic decisions around the world, at all levels, and of course that should be some of the main jobs of our economists, to find these stories. Look at how it affects people, and what policies we can have to deal with those parts.